Best Accounting Software for Shopify in 2025: A Comprehensive Comparison

Accounting is a notoriously resource-intensive activity.

In fact, the monthly close — an accounting process that closes out the previous month’s financial activity — takes the average business an eye-watering 6.4 days to complete, rising to 10+ days for the bottom 25% of organizations.

Most e-commerce entrepreneurs would much rather spend that time on something more valuable, like promoting their store, meeting with suppliers, or researching new product lines.

That’s why it’s well worth investing in Shopify accounting software to make your bookkeeping procedures a whole lot more efficient.

Not sure where to start? You’re in the right place, because we’ve rounded up the 11 best accounting tools and platforms for small and large Shopify stores.

Let’s get into it…

11 Best Shopify Accounting Software: Comparison Table

| Platform | Best for | Price | Review score |

| FreshBooks | SMEs | $19 – $60+ per month | 4.5/5 (G2) |

| Wave | SMEs | $0 – $16 per month | 4.4/5 (G2) |

| Xero | SMEs | $15 – $78 per month | 4.3/5 (G2) |

| Zoho Books | SMEs | $0 – $275 per month | 4.5/5 (G2) |

| Intuit QuickBooks | SMEs | $30 – $200 per month | 4.4/5 (G2) |

| Synder | SMEs | $61 – $275+ per month | 4.7/5 (G2) |

| Sage 50 Accounting | SMEs | $58.92 – $160 per month | 3.8/5 (G2) |

| Kashoo | SMEs | $18 – $27 per month | 4.6/5 (G2) |

| NetSuite Cloud Accounting Software | Larger retailers | ~$999 per month, plus ~$99 per user per month (also requires one-time integration fee) | 4/5 (G2) |

| SAP Business ByDesign | Larger retailers | ~$1,700 per month, plus ~$20 – $200 per user per month (also requires one-time integration fee) | 4/5 (G2) |

| Oracle Fusion Cloud Financials | Larger retailers | ~$600 per user per month (also requires one-time integration fee) | 4/5 (G2) |

Best Accounting Software for Small Shopify Stores

Let’s start with the small business owners. You need a Shopify accounting solution that’s affordable and easy to use but also provides all the functionality you need to manage the finances of a growing business. Plus, you want a tool that scales with your store.

Here are our favorite options:

FreshBooks

Summary

FreshBooks is an easy-to-use accounting and bookkeeping platform built for business owners and accountants. It claims business owners can save 553 hours a year by using FreshBooks.

What We Like

- FreshBooks has one of the most user-friendly interfaces on the market, making it easy to pick up — even if you’re not a natural “numbers person”.

- The lowest and mid-tier plans are suitable for most small Shopify stores, so it’s pretty affordable.

- Excellent dedicated mobile app for Android and iOS allows you to keep on top of your accounts while you’re away from your desk.

What We Don’t Like

- No native Shopify integration (and the only dedicated Shopify app, FreshBooks Link by CarryTheOne, has only been reviewed twice in 15 years).

- Costs $11 per month for each team member you add to FreshBooks, which adds up fast for larger teams.

- Fewer customization options than some of the other Shopify accounting platforms.

Price

As standard, FreshBooks charges $19 – $60+ per month, depending on the number of clients you need to invoice and the features you want to access. Save 10% by paying annually rather than monthly. FreshBooks also runs regular price promotions (e.g. at time of writing, it was offering 50% off for three months).

Wave

Summary

Wave Accounting is a small business accounting platform that allows users to create invoices, accept online payments, organize expenses, and more. More than two million small businesses across North America have used Wave to handle their accounting.

What We Like

- One of the most cost-effective Shopify accounting solutions, including a superb free-for-life plan.

- Offers a solid native Shopify integration, Sync to Wave.

- Send invoices and track payments on the go using the Wave mobile app for Android and iOS.

What We Don’t Like

- With only one paid plan and limited advanced features, Wave is less scalable than many other Shopify accounting tools.

- Free plan only includes self-service customer support.

- Lack of an audit trail makes it hard to verify your accounting data.

Price

Wave Accounting offers an excellent free-for-life plan that lets you create unlimited estimates, invoices, bills, and bookkeeping records. Upgrade to the paid plan for $16 per month to access additional features like automated late payment reminders and auto-imported bank transactions.

Xero

Summary

Xero is accounting software for small businesses, accountants, and bookkeepers. it’s used by over 3.95 million subscribers, making it one of the most popular tools on the market.

What We Like

- Native Shopify integration automatically syncs a daily summary of your Shopify sales with Xero at the end of each day.

- Offers advanced functionality like automated sales tax calculations and short-term cash flow snapshots on all plans.

- Highly rated Android and iOS apps, each with 13,000+ reviews.

What We Don’t Like

- Harder to navigate than some of the simpler small business-oriented Shopify accounting tools.

- Entry-level plan only lets you send up to 20 invoices.

- Personalized customer support only available via email.

Price

Xero offers three paid plans, ranging in price from $15 – $78 per month, although it runs regular discounts (e.g. at time of writing, it was offering 60% off for the first four months).

Zoho Books

Summary

Zoho Books is Zoho’s small business accounting platform. It helps Shopify store owners manage their finances, automate various business workflows, and work more collaboratively with team members.

What We Like

- Wide range of price plans (including an excellent free plan) allows Zoho Books to scale with your business.

- Add multiple users on all paid plans.

- Excellent Android and iOS apps.

What We Don’t Like

- The single biggest drawback of Zoho Books is that you’ll need to upgrade to Elite level or higher ($150+ per month) to integrate your Shopify store. However, this price includes two Shopify stores.

- Similarly, custom reporting is only available at Elite level and above.

Price

Zoho offers no fewer than six plans, ranging from a free tier for businesses generating annual revenues of <$50,000 to the Ultimate plan for businesses that need 15+ users. Save $5 – $35 per month on paid plans by paying annually.

Intuit QuickBooks

Summary

Intuit QuickBooks is a small business finance tool that helps users track, organize, and manage their finances. It’s comfortably the biggest name in small business accounting, with a market share of ~80%.

What We Like

- All plans offer built-in bookkeeping automation, saving you time and money.

- Offers a highly regarded (and free) native Shopify integration, Shopify Connector by Intuit, to synchronize all your inventory and accounting data. As an added bonus, it also allows you to connect with other e-commerce apps like eBay and Amazon.

- As the market leader, QuickBooks is widely used by accountants and bookkeepers.

- Mobile apps for Android and iOS are highly rated and have tens of thousands of reviews.

What We Don’t Like

- More expensive than most small business accounting tools.

- No free plan, so if you want to give QuickBooks a try, you’ll have to choose the 30-day free trial.

- Steeper learning curve than many of the alternatives, especially if you don’t have any accounting experience.

Price

Intuit QuickBooks doesn’t offer a free plan (although it does have a 30-day free trial). Its standard prices range from $30 – $200 per month, depending on features. But at time of writing, it was offering a 50% discount for the first three months.

Synder

Summary

Synder is a little different from the other tools in our roundup. Rather than a standalone solution, it’s effectively a bridge between accounting platforms like QuickBooks, Sage, and Xero and e-commerce tools such as Shopify, Amazon, and Etsy.

What We Like

- Includes free integrations with 25+ e-commerce and accounting tools.

- Get unlimited access to historical data on all plans.

- Every plan includes multicurrency tracking, making it a good fit for Shopify stores with international audiences.

What We Don’t Like

- Comparatively expensive (plus you need to pay for a separate accounting tool as well).

- Entry-level plan only supports up to 500 transactions per month.

- Customers on the lowest-tier plan only get support via email.

Price

Synder charges $61 – $275+ per month, although you get a 20% discount for paying yearly. There’s no free plan, but it does offer a 15-day free trial.

Sage 50 Accounting

Summary

Sage is one of the biggest names in business management software, with over two million businesses using its various tools. Its small business accounting solution, Sage 50 Accounting, is a desktop platform with cloud connectivity.

What We Like

- The dashboard is highly customizable, allowing you to select the fields you want to see and where you want them to appear.

- Reporting templates are more extensive than any other small business accounting software we’ve looked at, covering receivables, payables, payroll, inventory, jobs, and more.

- In-depth inventory tracking incorporates multiple price levels, item types, and locations.

What We Don’t Like

- Sage doesn’t have a native Shopify integration, so you’ll need to rely on one of the many third-party alternatives in the Shopify App Store.

- Standard prices are only for a single user; you have to upgrade to the mid-tier plan and pay a higher price for multiple seats.

- Audit trails are only available at Premium level and above ($96.58+ per month).

Price

Sage 50 Accounting doesn’t offer a free plan, but it does have a 30-day free trial. Paid plans range from $58.92 – $160 per month, with discounts available if you pay annually rather than monthly.

Kashoo

Summary

Kashoo claims to be the world’s simplest accounting software, offering easy-to-use features for invoicing, expense tracking, and more. Its accounting apps have been praised by the likes of Forbes, Inc, and Mashable.

What We Like

- Despite being built for small businesses, Kashoo allows you to add unlimited users on both its paid plans.

- Kashoo has mobile apps for Android and iOS.

- Offers a bunch of free templates for small business owners, covering common accounting tasks like budgeting, invoicing, and reporting.

- Super simple to get started, even if you’re not a natural accountant.

What We Don’t Like

- At time of writing, there’s no way to integrate Kashoo with Shopify, so you’ll need to spend some time entering data manually.

- No free tier, so you’ll have to rely on the 14-day trial to see if Kashoo is right for you.

- More limited reporting functionality than platforms like Sage (and the reporting templates aren’t customizable).

Price

Confusingly, Kashoo offers two different packages: one called Trulysmall Accounting and another called Kashoo. Both are priced annually, with trulySmall Accounting costing $216 per year and Kashoo $324 per year. Both plans offer a 14-day free trial.

Best Accounting Software for Larger Shopify Stores

Next up, let’s take a look at Shopify accounting tools for larger retailers. With your nationwide (or maybe international) presence, you’re likely pulling financial data from multiple sources — and you need an accounting solution that’s up to the task. Advanced automations and sophisticated reporting are a must for retail businesses in this category.

Here are our top picks:

NetSuite Cloud Accounting Software

Summary

As you’ve likely guessed, NetSuite Cloud Accounting Software is the built-in accounting solution for the NetSuite ERP platform. It promises to provide a complete view of your cash flow and financial performance.

What We Like

- Offers real-time visibility into all your financial data, enhancing decision-making.

- Integrate with Shopify via NetSuite Connector to track items across multiple locations, automate order management, and streamline accounting tasks (N.B. requires an additional fee of $199.92+ per month).

- Sophisticated automations reduce the burden of essential but labor-intensive accounting processes.

What We Don’t Like

- Many reported issues with NetSuite’s dedicated Android and iOS apps, with users complaining of vanishing reports and a lack of dashboards.

- Customizing the platform requires a decent amount of technical knowledge.

- The user interface feels less intuitive than some other platforms, making it harder to get started.

Price

To use NetSuite Cloud Accounting Software, you’ll have to sign up for an annual license comprising three elements: the core platform, optional modules, and per-user fees. NetSuite doesn’t publish pricing information, but from our research, expect to pay ~$999 per month, plus approximately $99 per user per month. NetSuite also charges a one-time implementation fee, which can run to tens of thousands of dollars depending on the complexity of your operations.

SAP Business ByDesign

Summary

SAP Business ByDesign is a cloud-based ERP solution aimed at fast-growing midsize businesses. The platform is used by companies in 160+ countries.

What We Like

- Comes loaded with prebuilt processes covering everything from finance and sales to product management and purchasing.

- Gives users access to real-time financial analytics, speeding up decision-making processes.

- Offers dedicated Android and iOS apps, although it should be noted the reviews aren’t spectacular.

What We Don’t Like

- No native Shopify integration (although there are plenty of third-party options, all carrying an additional cost).

- Pre-configured workflows might allow for faster deployments, but they’re tricky to customize.

- Designed for larger SMBs, so enterprise-grade customers may need a higher-end solution.

Price

SAP doesn’t publish pricing information for Business ByDesign. But after a little digging, we found the base package costs around $1,700 per month, while per user charges range from approximately $20 – $200 per month. You’ll also have to pay a one-off implementation fee, which varies based on your business needs.

Oracle Fusion Cloud Financials

Summary

Oracle Fusion Cloud Financials is a global financial platform capable of joining the dots between, and automating, your various financial management processes — from payables and receivables to expenses and fixed assets. Oracle says its built-in AI automates up to 96% of standard transactions.

What We Like

- Shopify Adapter integration syncs data between Shopify and Oracle Fusion Cloud Financials.

- Extensive automations improve efficiency and eradicate errors from common accounting tasks.

- Out-of-the-box support for multiple currencies, languages, and accounting standards.

What We Don’t Like

- Just like NetSuite, there are a whole bunch of complaints about Oracle’s mobile apps.

- High per-user pricing means costs add up fast for larger retailers.

- Learning curve can be pretty steep.

Price

Again, Oracle isn’t the most transparent about its pricing, but our research suggests you’ll be paying ~$600 per user per month for Fusion Cloud Financials. Plus you should expect a hefty one-time implementation fee.

How To Choose the Best Shopify Accounting Software

We’ve (metaphorically) roamed the length and breadth of the Shopify accounting software market to bring you the very best solutions. But how do you decide which is right for your business? Consider the following factors when choosing your accounting software:

Does It Meet the Financial Management Needs of Shopify Stores?

Fact is, the vast majority of accounting tools aren’t built specifically with Shopify stores — or even e-commerce in general — in mind. So you’ll need to check that your favored solution offers retail-friendly functionality like:

- Inventory tracking

- Order management

- Sales reporting

Does It Integrate With Shopify?

Another key point: if your chosen tool doesn’t offer some form of Shopify integration, you’re going to have to spend a bunch of time manually sharing data between the two platforms.

If you’re a small retailer who just needs a simple accounting tool to handle basic tasks like invoicing, it might not be a deal-breaker if a tool doesn’t integrate with Shopify. But for larger stores with multiple suppliers and thousands of transactions a month, you really need Shopify and your accounting platform to play nice together.

Can I Get Up and Running Fast?

Inevitably, the more bells and whistles your accounting tool offers, the more complex it will be to use. If you’re not super experienced with accounting software, it might be worth sacrificing some more advanced features in favor of all-around user-friendliness.

Will It Scale With My Business?

You may be a small, one-person operation right now — but you might not want to stay like that forever! No accounting tool is suitable for literally every business, but if you’re growing fast, it’s better to choose a solution capable of adapting to your changing needs. Otherwise, you’ll be chopping and changing tools every 12 months.

Key Benefits of Using Shopify Accounting Software

Unless you choose a free-for-life solution like Wave or Zoho Books, your Shopify accounting software is going to cost you at least a few hundred dollars a year (and potentially a lot more). Is it really worth the money?

In our view, the answer is a resounding: “Yes.”

Here are the key benefits of choosing a Shopify accounting tool:

More Efficient and Accurate Than Excel

Sure, you can always manage your cash flow, expenses, and invoicing in Excel. But that approach can quickly get out of control as your business scales.

Soon, you’ll find yourself frantically flicking through multiple identical-looking spreadsheets looking for the correct version with the right data.

Relying on Excel to handle all your accounting needs also leaves you open to human error. If you pull data from an outdated spreadsheet or accidentally edit a formula, you’re in for a world of pain!

Streamlined Financial Management

Most e-commerce entrepreneurs don’t start a Shopify store because they really love accounting. So why spend a massive chunk of your valuable time on repetitive, labor-intensive tasks like invoicing when you could pay a tool a few bucks a month to do it for you?

That way, you get to focus your energies on the stuff that makes the biggest difference to your growing business.

Smarter Decision-Making

Even if you think of yourself as e-commerce’s answer to Nostradamus, you shouldn’t rely on gut feeling alone to inform business-critical decisions. Instead, you’ll want to rely on real-time and historical performance data to understand the right course of action.

Is this a good time to launch a new product? Would we grow faster if we doubled our marketing budget? How much does it cost us to have unsold stock in our warehouse?

With the right accounting software, you can answer all those questions (and way more besides), setting you up for sustainable growth.

Shopify Accounting Software FAQs

Which Accounting System Is Useful for Small Businesses?

There are lots of small business-friendly accounting tools. Choosing the right option will depend on your specific needs and budget, but some of the best options include:

- FreshBooks

- Wave

- Xero

- Zoho Books

- Intuit QuickBooks

- Synder

- Sage 50 Accounting

- Kashoo

What Accounting Software Do Most Small Businesses Use?

Intuit QuickBooks is comfortably the most popular small business accounting software, with an estimated market share of around 80%. However, that doesn’t mean it’s the best option for you. QuickBooks is more expensive than most of the alternatives, and it also has a steeper learning curve. Plus, it doesn’t offer a free plan, so you can only try it out by signing up for a free trial.

Why Is QuickBooks Best for Small Businesses?

QuickBooks is the most popular small business accounting tool because it’s good at what it does. We love the fact that it includes book-keeping automation on all plans, and it has a high-quality free Shopify integration to sync all your accounting and inventory data. The dedicated Android and iOS apps are excellent, too. But, as we’ve already noted, it’s certainly not the most affordable solution for small businesses.

Which Accounting Software Is the Cheapest?

After analyzing the market, we’re confident that Wave is the cheapest accounting software. If you’re just looking for a tool to handle estimates, invoices, bills, and bookkeeping, Wave does it all free of charge — and you can’t get cheaper than that.

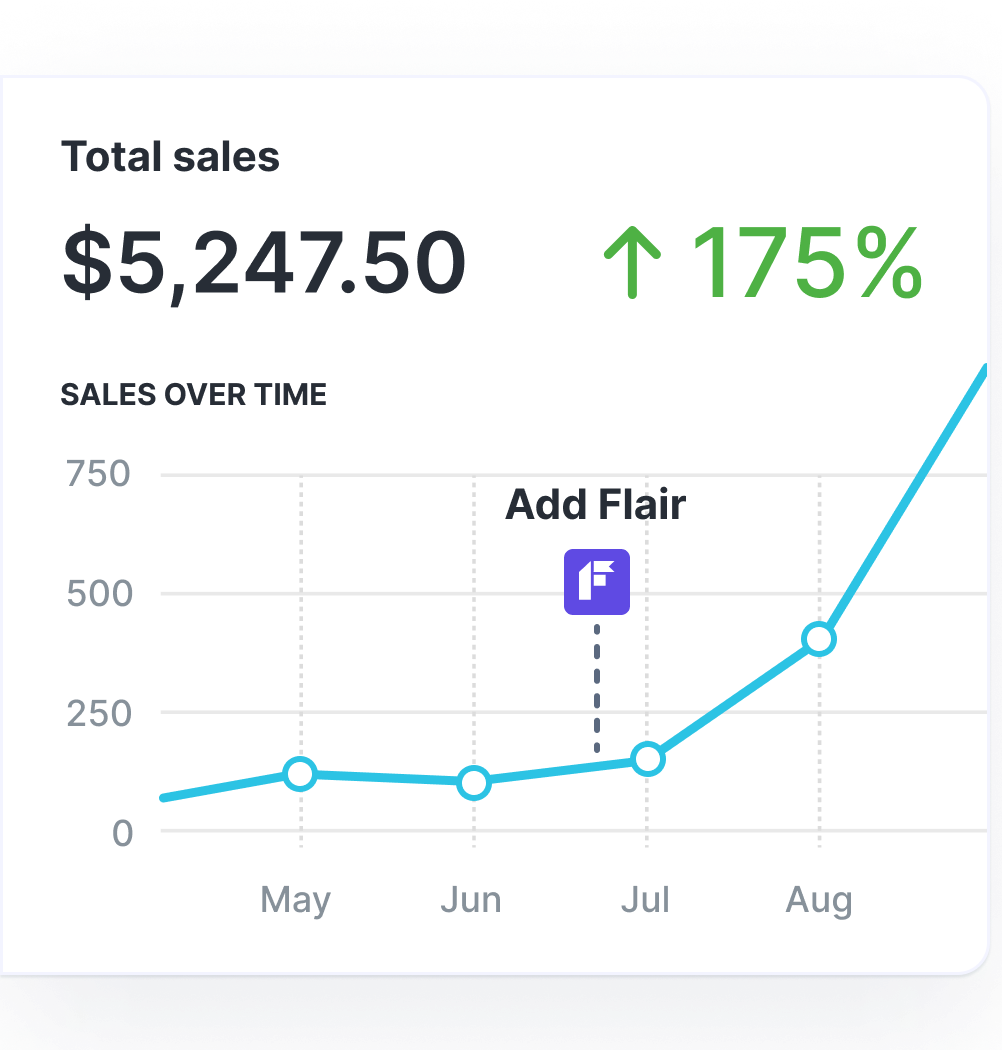

Grow Your Shopify Sales by over 175% with Flair

-

Increase sales using product badges and sales banners

-

Maximize conversions with scarcity, urgency and countdown timers

-

Automate promotions with targeted rules and scheduling