Does Shop Pay Check Credit?

As a Shopify merchant, you’ve definitely encountered Shop Pay. Shop Pay has processed over $110 billion in gross sales since launching in 2017.

Given that taking payments is one of the most important elements of running an e-commerce store, you’ve likely got a ton of questions.

Like what exactly is Shop Pay? How does it work? And does it check credit?

Read on to find the answers to all those questions (and much more besides)...

What Is Shop Pay?

Shop Pay is Shopify’s accelerated checkout option, allowing customers to purchase products in a single click or tap using the Shop Pay button.

It also offers a buy-now-pay-later (BNPL) facility, which means shoppers can spread the cost of their purchase over an agreed period — ranging from eight weeks to 12 months.

When buying through Shop Pay, customers can use their…

- Visa credit or debit card

- Mastercard

- American Express

…plus other cards supported by your store.

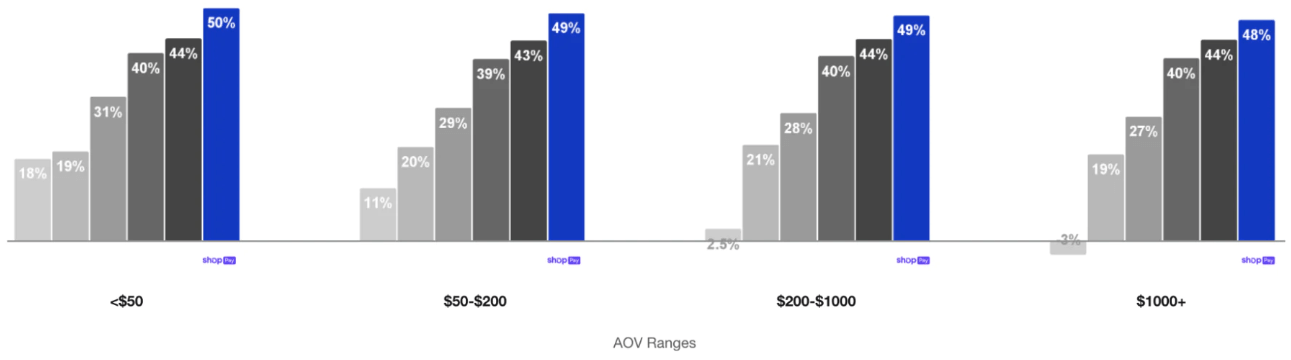

According to a study completed in partnership between Shopify and a big three consulting firm, Shop Pay boosts conversion rates by up to 50% versus guest checkout options.

And it also outperforms other accelerated checkout solutions by at least 10%.

Impressively, even when the buyer doesn’t use Shop Pay, it still delivers a 5% uptick in conversions at the bottom of the sales funnel.

In short, Shop Pay makes life easier for customers purchasing on your Shopify store.

And convenience means more sales and revenue.

Pro tip: Learn how to convert more customers by reading our guide: How To Increase Conversion Rates on Shopify.

How Does Shop Pay Work?

Shop Pay works by storing (and encrypting) the customer’s payment and shipping information.

That way, when an existing Shop Pay user clicks the “Buy With Shop Pay” button…

…their purchase is completed instantly — because Shopify already has their details.

That’s the basics of Shop Pay.

Pro tip: Check out our Shopify Accounting Software guide where we review the best options for managing the financial side of your Shopify store.

But things are actually a little more complicated, because there are two different varieties of Shop Pay transactions:

- Pay in full: Like it sounds, the customer pays the full price of the product (plus shipping costs and any other fees) during the checkout process.

- Shop Pay Installments: This is a BNPL service, allowing customers to pay for purchases of $50 – $17,500 over time rather than upfront (although the minimum amount varies by retailer).

Where Can Customers Use Shop Pay?

Customers can use Shop Pay when buying products from 289,000 Shopify stores.

In fact, they don’t even have to visit the store itself to use Shop Pay, as it also works through third-party commerce platforms like Facebook, Google, and Instagram.

However, it’s important to note that Shop Pay isn’t a global feature.

For starters, Shop Pay Installments can only be used by customers with a US billing address.

And while pay-in-full functionality has a wider reach, it’s still limited to stores located in countries that are approved for Shopify Payments.

At time of writing, Shopify Payments works in 23 countries, including the US, most of Europe, and parts of Asia and Oceania.

Pro tip: Check your eligibility by viewing the full, up-to-date list of countries in which Shopify Payments is available.

Does Shop Pay Check the Customer’s Credit?

The answer to that question is: sometimes.

It all depends on the type of Shop Pay transaction the customer chooses…

Pay in Full at Checkout

If the customer is making a plain old pay-in-full purchase, they fork over the cash during the checkout process, just like with any other transaction.

So there’s obviously no need for a credit check.

Shop Pay Installments

Shop Pay Installments is different.

As it’s a BNPL service, it involves spreading the cost of a product over time, so it’s a form of credit — and it’s (understandably) only available to customers aged 18+.

Still, not all of these transactions require a credit check, because there are two different categories of Shop Pay Installments:

| Shop Pay Installments type | Availability | Payment terms | Requires credit check? |

| “Pay in 4” | On purchases of $50 – $999* | Four interest-free payments, paid every two weeks | No |

| Pay monthly | On purchases of $150 – $17,500* | Available over three, six, or 12 months, with rates from 0% – 36% APR | Yes |

* Minimum amount varies by retailer

For instance, a customer using Shop Pay Installments to purchase a $800 chair could pay it off in four bi-weekly payments of $200, which wouldn’t require a credit check.

Or they could choose to pay monthly over three, six, or 12 months, in which case they’d be credit checked and — if eligible — given an APR and a monthly payment amount.

Other Shop Pay FAQs

How Do Merchants Set Up Shop Pay?

Shop Pay is automatically available to any merchants using Shopify Payments.

Follow these steps to set up Shopify Payments:

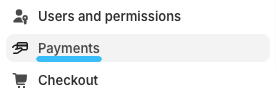

- Log in to your Shopify admin.

- Click Settings in the left-hand menu.

- In the left-hand menu of the Settings screen, click Payments.

- Click the Activate Shopify Payments button (N.B. this button will be grayed out if your store isn’t live yet).

A new area will now be added to the Payments section, titled Shopify Payments. Click Manage, then tick the box next to Shop Pay, to add it to your store.

And that’s it — you’re all set to offer customers the opportunity to make fast, convenient purchases through Shop Pay.

Does Shop Pay Charge Merchant Fees?

Activating Shop Pay doesn’t cost you any additional money — it’s technically a free service.

However, it does charge the same fees on credit card payments as any other transaction made through Shopify Payments.

These fees vary based on your Shopify plan and location; here’s how they look for the US:

- Shopify Basic: 2.9% + $0.30 per online transaction; 2.6% + $0.10 per in-person transaction

- Shopify: 2.7% + $0.30 per online transaction; 2.5% + $0.10 per in-person transaction

- Shopify Advanced: 2.5% + $0.30 per online transaction; 2.4% + $0.10 per in-person transaction

You’ll also be charged fees of 5% – 6% per transaction for any purchases made through Shop Pay Installments.

That’s why some merchants choose to set a higher minimum purchase amount for these transactions.

Does Shop Pay Charge Interest?

Shop Pay doesn’t charge interest on purchases that are paid for in full during the checkout process, or on “Pay in 4” transactions through Shop Pay Installments.

However, it does charge interest on Shop Pay Installments monthly payments.

The APR varies from 0% – 36%, depending on the customer’s credit check results.

Does Shop Pay Ship After First Payment?

When a customer pays in full at checkout using Shop Pay, you get the money immediately.

Alternatively, when they pay with Shop Pay Installments, you receive full payment within three business days, minus a fee of up to 6%. You get paid by Affirm, the financial company that runs Shop Pay Installments, so there’s no need to chase up customers for payment. The money is sent to the same bank account you use for Shopify Payments.

All of which means there shouldn’t be any reason to delay the order processing or shipping time.

What Are the Requirements for Shop Pay?

Shop Pay is essentially an extension of Shopify Payments, so you must be based in one of the 23 countries in which Shopify Payments is available (check the full, up-to-date list here).

Beyond that, you have to fulfill some additional requirements if you want to offer Shop Pay Installments. Specifically, you have to:

- Be located in the US

- Sell in USD

How Does Paying With Shop Pay Work?

There are two ways for customers to make purchases using Shop Pay.

They can either pay in full during the checkout process, in which case it’s just like a “standard” transaction — only faster, because they can pay with a single click.

Or, if they have a US billing address, they can buy now, pay later by choosing Shop Pay Installments.

If they go for option #2, they get a further two choices:

- Pay in four equal, interest-fee installments, paid every two weeks

- Pay monthly over three, six, or 12 months, subject to a credit check and an APR of 0% – 36%

What Are the Disadvantages of Shop Pay for Merchants?

From the perspective of an e-commerce store owner, there are a couple potential problems with Shop Pay:

- Shop Pay Installments charges additional transaction fees of 5% – 6%, which eats into your profit margins.

- It’s a Shopify product, so if you use a rival e-commerce platform like BigCommerce or WooCommerce, you can’t use Shop Pay.

- You also can’t use it if you’re based somewhere other than the 23 countries where Shopify Payments is available.

- Shop Pay Installments is only available to customers in the US, so if that’s not your primary market, you’ll need to find a different BNPL solution.

- It’s a Shopify product, so if you use a rival e-commerce platform like BigCommerce or WooCommerce, you can’t use Shop Pay.

- Shop Pay Installments charges additional transaction fees of 5% – 6%, which eats into your profit margins.

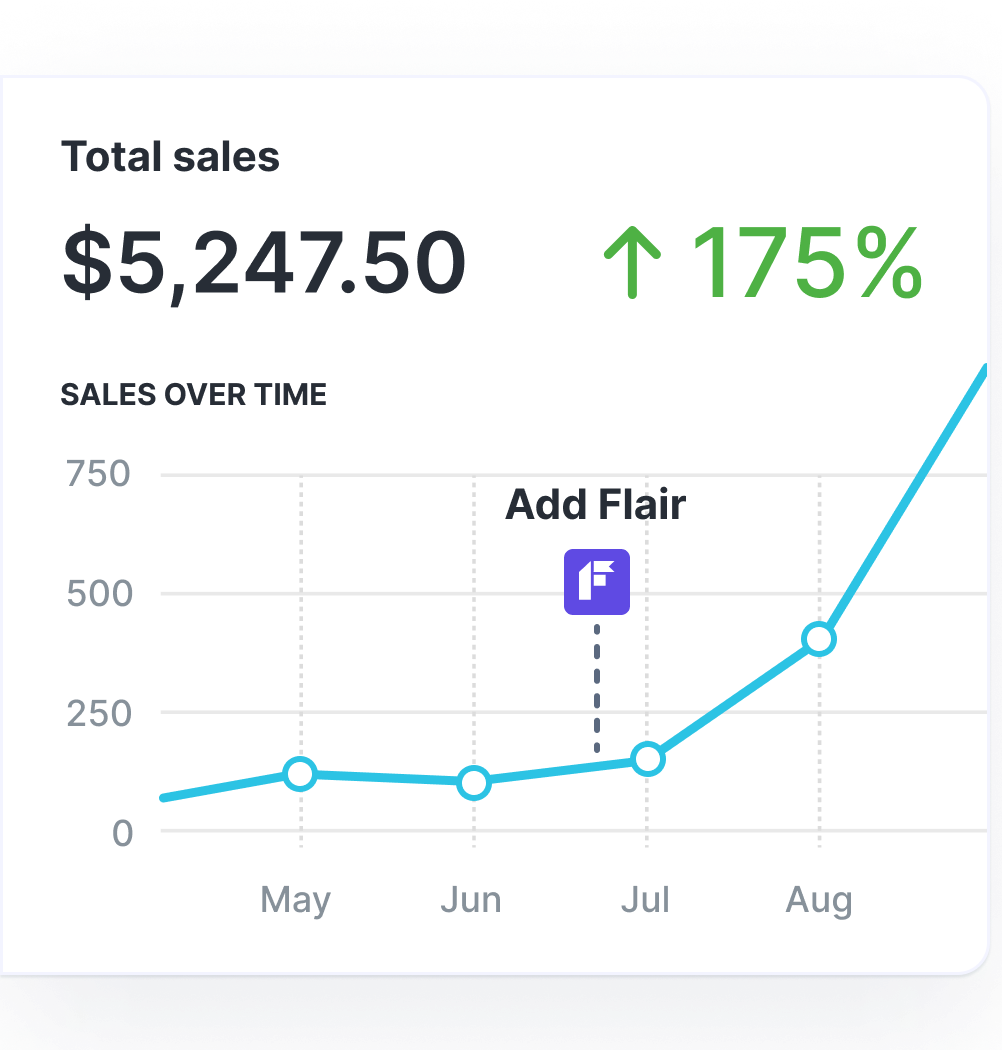

Grow Your Shopify Sales by over 175% with Flair

-

Increase sales using product badges and sales banners

-

Maximize conversions with scarcity, urgency and countdown timers

-

Automate promotions with targeted rules and scheduling