How to Price Products on Shopify: Complete Pricing Strategy Guide (2025)

Pricing products is easy – just slap on a profit margin and you’re good to go, right?

Unfortunately not. There are a ton of factors to consider when setting prices, including:

- The level of demand for your product

- Your competitors’ pricing strategies

- The strength and status of your brand

Read on for our step-by-step guide to setting product prices on Shopify (plus an overview of pricing strategies and best practices)…

A Simple 4-Step Guide for Setting Product Prices

Sure, product pricing is more complex than adding a markup. But once you know what you’re doing, it’s a repeatable process – you don’t need Pythagoras-level math knowledge to calculate product prices. Get it right by following these four steps:

Step #1: Calculate Variable Costs Per Product

For starters, you need to figure out your total costs for each product.

First up, calculate your cost of goods sold (COGS). If you purchase products from a third-party supplier then sell them through your Shopify store, this is a simple process – your COGS is simply the amount you pay per unit for each product.

Things get a little more murky if you make your own products because you’ll have to add up the combined costs of your…

👉 Labor

👉 Raw materials

👉 Overheads

…and anything else that goes into producing a product. This isn’t an exact science (especially if you literally build your products by hand yourself), but it’ll at least give you a rough estimate of your COGS. Which is better than nothing.

At this point, you should also factor in other variable expenses, like:

👉 Packaging

👉 Marketing

👉 Shipping

Create a spreadsheet containing all those variable costs and calculate your total product cost per unit. It should end up looking something like this:

| Variable cost | Amount |

| COGS | $5 |

| Marketing | $1.50 |

| Packaging | $2 |

| Shipping | $2.50 |

| Affiliate commissions | $3 |

| Total variable product cost per unit | $14 |

Step #2: Add Your Desired Profit Margin

Now it’s time to think about profits.

When calculating your desired profit margin, bear in mind that so far, you’ve only factored in your variable costs. You’ve got fixed costs to pay, too – and your profit margin should allow you to at least break even once you’ve accounted for all those outgoings.

At the same time, remember that there are likely thousands of other stores out there selling products like yours. Sure, your product might be better than the competition, but if it’s also 10 times more expensive, it’s gonna be a tough sell.

So, to sum up, your profit margin should be:

⬇️ Low enough to make your product pricing attractive

⬆️ High enough to cover your fixed costs

That’s a real head-scratcher, huh?

Clearly, there’s no one-size-fits-all solution here. You’ll have to do your market research to see what your competitors are charging, then play around with some numbers until you land on a healthy-looking margin. To get there, use the following formula:

👉 Target price = (Total variable product cost per unit) / (1 - your desired profit margin, expressed as a decimal)

For instance, in the above example, our product has a variable cost per unit of $14.

Now, say we’re aiming for a 30% profit margin. When expressed as a decimal, that’s 0.3 – so we’d subtract 0.3 from 1 to leave us with 0.7. Then we divide $14 by 0.7 to give us a nice, round target price of $20.

Step #3: Factor in Fixed Costs

Now it’s time to figure out those pesky fixed costs.

Fixed costs are those that exist regardless of how many products you sell, including things like:

👉 Permits

👉 Warehousing

👉 Software licenses

👉 Insurance

👉 Payroll

Adding up all your fixed costs over a given time period will help you figure out how many products you need to sell at your desired profit margin in order to break even.

For example, say our fixed costs for Q1 add up to $6,000.

At our 30% profit margin, we’re earning $6 per unit before factoring in fixed costs. So if we sell 1,000 units, we’ve broken even in Q1 – any units sold on top of that are pure profit 🤑

Step #4: Update Prices as Necessary

As you can likely imagine, product pricing isn’t a one-and-done exercise – there are far too many variables.

For instance, consider the impact of:

👉 A cut-price disruptor entering your niche

👉 A rise in gas prices leading to higher shipping costs

👉 An increase in your warehousing fees

In any of those scenarios, you’d either have to increase your prices or accept a tighter product margin – which might not be an option if you’re only just breaking even.

With that in mind, you’ll want to regularly review your prices – say, once per quarter – to see whether it makes sense to raise, lower, or freeze them.

Choosing Your Pricing Strategy

We’ve looked at the nuts and bolts of setting product prices, but we kinda glossed over the whole issue of choosing your profit margin. There are various strategies around setting your margin (and, therefore, your total product price), including…

Competitive Pricing

Competitive pricing, also known as competition-based pricing, is when you use the price of similar products to calculate your own product pricing. At the same time, you’d want to consider factors like:

👉 The state of the market

👉 The perceived value of your product

Example

Our Shopify store sells super durable phone cases. Market research tells us that our biggest competitors charge $30 – $40 per case. As a newcomer to the market, we don’t have the brand strength of our better-established rivals, so we set our prices at the lower end of that range.

Cost-Plus Pricing

This simple model forms the basis of the four-step product pricing process we laid out above. It involves calculating a selling price by adding a percentage markup to your COGS.

Example

Our durable phone cases cost $15 per unit to manufacture, promote, and ship. We’re targeting a profit margin of 30%, which gives us a sale price of $19.50.

Value-Added Pricing

This strategy is less about the cost of physically “making” your product, and more about its perceived value. That $1,000 Balenciaga T-shirt cost at most a couple bucks to produce – but, because they’re an aspirational brand with baked-in exclusivity, people are happy to pay.

Example

For our latest phone case launch, we’re collaborating with Supreme, the premium streetwear brand. Our COGS still stands at $15 per unit. But, because we’re plastering the Supreme logo all over it, we can increase the sale price to $100.

Pro tip: Make premium products stand out in your store by using product badges like “Best Seller” or “As Seen On…”.

Dynamic Pricing

Dynamic pricing is a more complex model because prices update to match demand based on market conditions. It’s based on supply and demand – if a product is in short supply and lots of people want it, you can likely get away with charging more for it. That’s why your Saturday night Uber costs so much due to peak demand.

Example

Dynamic pricing can be tough for e-commerce companies to pull off, but there are some viable examples. For instance, a retailer selling flowers might increase prices in the run-up to Valentine’s Day or Mother’s Day.

Penetration Pricing

With penetration pricing, a store initially sets low pricing to undercut the competition, helping them gain share in a competitive market. Often, they’ll raise prices down the line once their brand is better established.

Example

Because the durable phone case market is so crowded, we sell our cases at cost price. We start adding some margin on top once we’ve built a customer base, gathered a bunch of positive reviews, and generally grown our reputation.

Psychological Pricing

The goal of psychological pricing is to make your products feel more affordable, valuable, or prestigious, thereby encouraging people to buy.

Example

Rather than selling our super durable phone cases for $40, we price them at $39.99. Our product margin is practically identical, but it feels more affordable to our customers.

Bulk Pricing

Bulk pricing is a promotional strategy in which the price of a product decreases when the customer adds more units to their cart. It can help Shopify merchants to increase average order value by cutting prices for bulk orders.

Example

Our phone case store charges $30 for a single phone case, with prices decreasing by 10% per unit for each additional case purchased.

Pro tip: Use product badges like “Wholesale” or “BOGO” to clearly display volume discounts.

4 Product Pricing Best Practices

With so many different pricing strategies to choose from, it can be hard to know where to start. Should we undercut the competition, or adopt a premium price point to strengthen our brand? Grow our average order value with bulk pricing, or use cost-plus pricing to protect our margins?

As ever, there’s no right or wrong answer – it all depends on your brand, market, and audience. But there are some general best practices to bear in mind:

Check Out Your Competitors

Never forget that your store doesn’t exist in isolation.

Sure, you might want to earn a margin of 50%. But if that’s going to push the price of your product way above what your competitors are charging for similar products, you’ll struggle to shift them.

If you don’t know who your biggest rivals are, just Google your product niche – like “durable iPhone cases” – then click through the top half-dozen-or-so results and calculate the average price of their products.

Test Different Pricing Levels

In the early days of your business, you’ve got plenty of scope to experiment with different pricing levels.

For instance, you could set your profit margin at 30% for three months, then reduce it to 20%. After another three months, crunch the numbers to see:

👉 How the change in pricing affected your sales

👉 Whether your total profits were higher before or after the price cut

Bear in mind that, when it comes to testing, you need to reach a large-enough sample size to produce meaningful results. Learn more about this in our guide to Shopify A/B testing.

Carry Out Market Research

Market research isn’t just about analyzing your competitors’ pricing.

You can also survey customers interested in your niche to better understand how to price your products. For instance, you might ask if they would…

👉 Pay more for a product with premium features

👉 Try a new brand/product if it was cheaper than their “regular” choice

👉 Buy multiple units of a product if bulk pricing was offered

Pro tip: Use simple online survey tools like Google Forms or SurveyMonkey to gather this data. If you’re struggling for responses, consider offering an incentive – like entering respondents into a prize draw.

Localize Product Pricing for Different Markets

Hopefully, if you sell to customers in multiple markets, you’re already allowing them to buy in their local currency. But it could also be worth lowering your prices to account for higher international shipping costs. Or you might keep your shipping rates low, but increase your standard product pricing to absorb some (or all) of the cost.

FAQs

How do you calculate the cost price of a product?

To calculate the cost price of a product, start by adding up all the direct and indirect costs that go into producing it, including:

- Materials

- Labor

- Overheads

Then divide your total costs by the number of units produced. For example, if your total costs are $1,000 and you produce 200 units, your cost price would be $5.

How much profit should I make on a product?

Retailers see an average gross profit margin of 53.33%, according to data from Lightspeed. So, on average, a product with a cost price of $20 would sell for just over $30. However, depending on your e-commerce niche, you may need to cut your margins to grow market share. Or, conversely, you may be able to charge a higher margin through value-added pricing.

What is a good price for a product that costs $10 to produce?

Based on Lightspeed’s average gross profit margin of 53.33%, a “good” price for a product that costs $10 to produce would be around $15. But you need to consider a lot of additional context when setting product prices. If customers refuse to pay more than $13 for similar products in your niche, $15 is clearly a bad price, because you won’t sell anything.

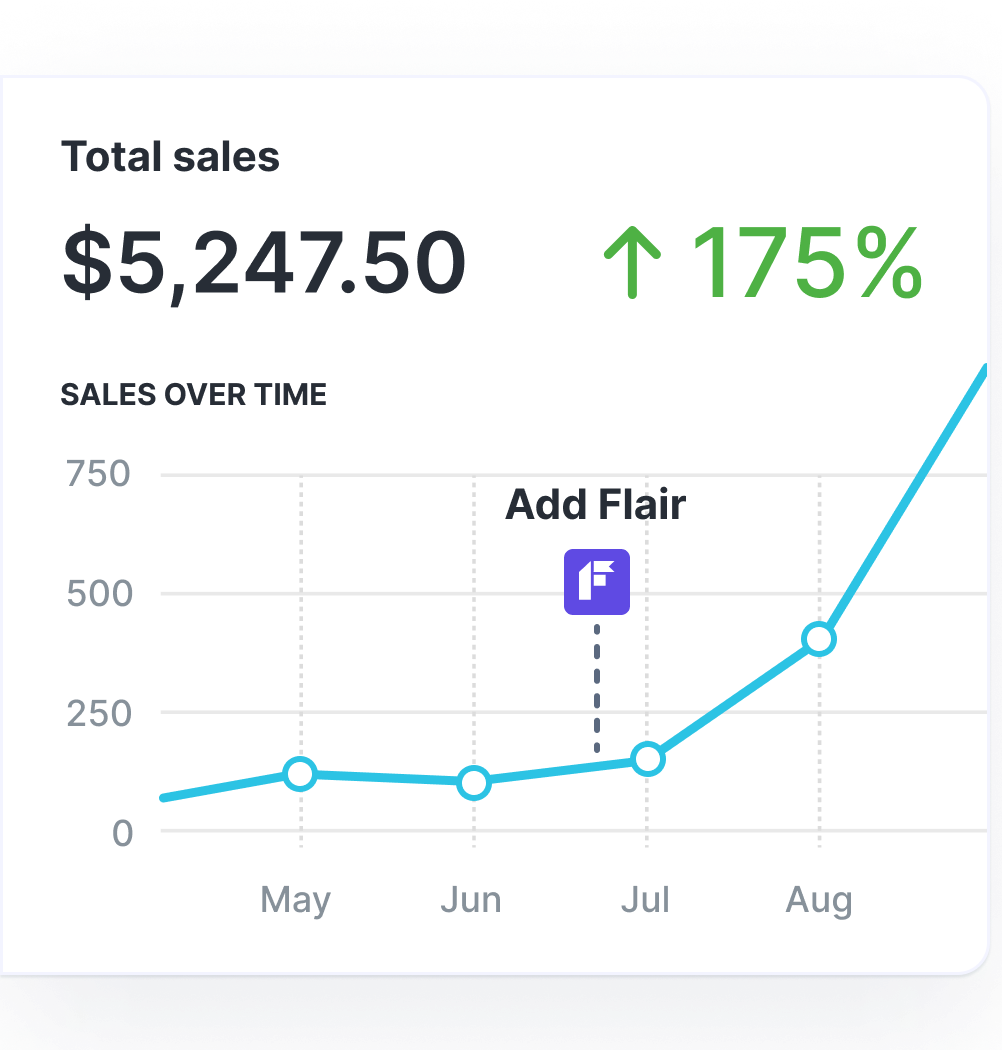

Grow Your Shopify Sales by over 175% with Flair

-

Increase sales using product badges and sales banners

-

Maximize conversions with scarcity, urgency and countdown timers

-

Automate promotions with targeted rules and scheduling